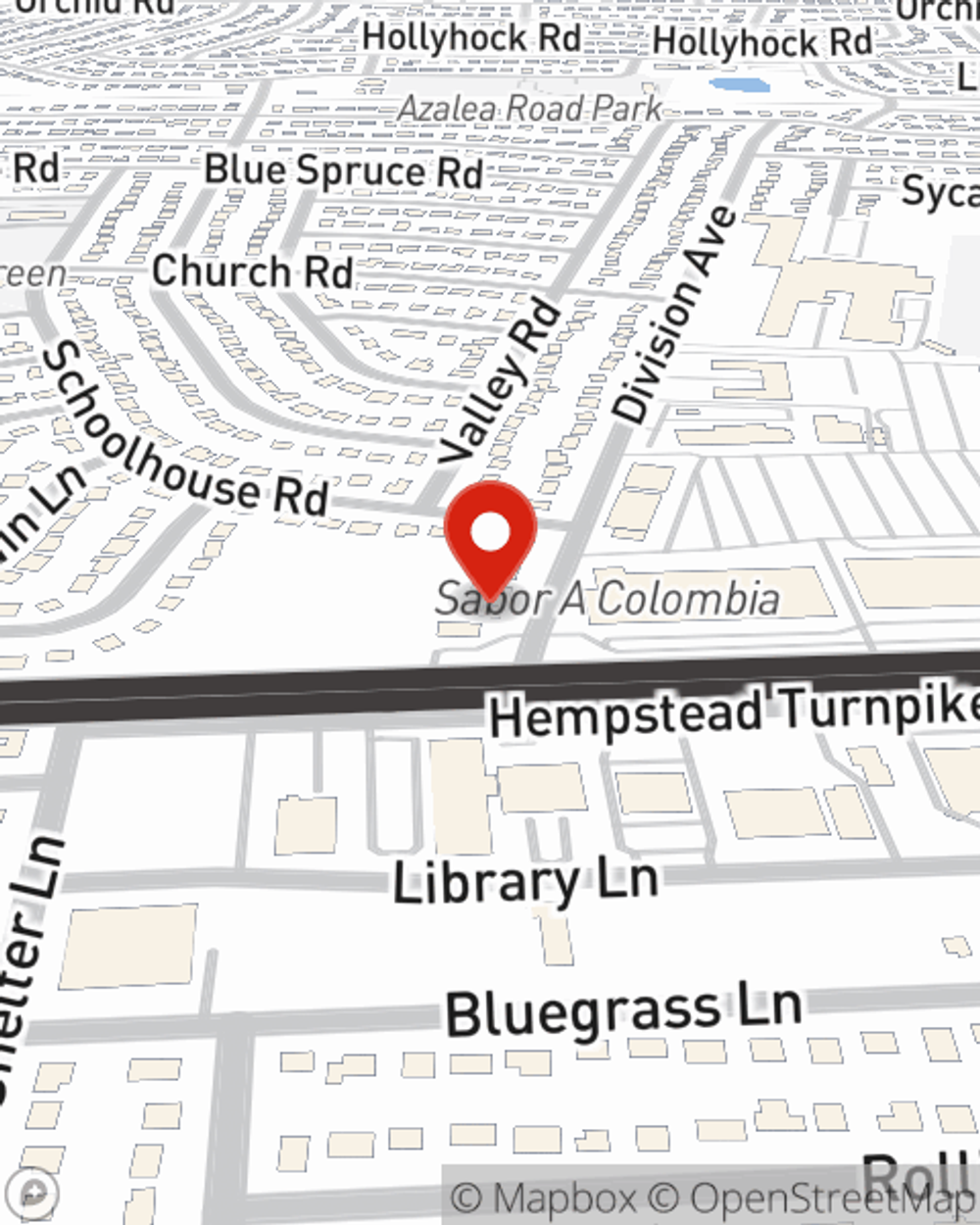

Renters Insurance in and around Levittown

Looking for renters insurance in Levittown?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

The place you call home is the cornerstone for everything you hold dear. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented apartment or home, you should have renters insurance—especially if you own items that would be difficult to fix or replace. It's coverage for the things you do own, like your sports equipment and tools... even your security blanket. You'll get that with renters insurance from State Farm. Agent Bob Masterson can roll out the welcome mat with the dedication and competence to help you insure your precious valuables. Skilled care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Looking for renters insurance in Levittown?

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

It's likely that your landlord's insurance only covers the structure of the townhome or space you're renting. So, if you want to protect your valuables - such as a bed, a set of cutlery or a recliner - renters insurance is what you're looking for. State Farm agent Bob Masterson has a true desire to help you understand your coverage options and protect your belongings.

Don’t let worries about protecting your personal belongings make you uneasy! Contact State Farm Agent Bob Masterson today, and find out how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Bob at (516) 826-1600 or visit our FAQ page.

Simple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Bob Masterson

State Farm® Insurance AgentSimple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.